Buy Now, Pay Later

- – 4-month term

- – No impact on credit

- – Instant approval decision

- – Secure and straightforward checkout

Ready to go? Add this product to your cart and select a plan during checkout.

Payment plans are offered through our trusted finance partners Klarna, Affirm, Afterpay, Apple Pay, and PayTomorrow. No-credit-needed leasing options through Acima may also be available at checkout.

Learn more about financing & leasing here.

This item is eligible for return within 30 days of receipt

To qualify for a full refund, items must be returned in their original, unused condition. If an item is returned in a used, damaged, or materially different state, you may be granted a partial refund.

To initiate a return, please visit our Returns Center.

View our full returns policy here.

Recently Viewed

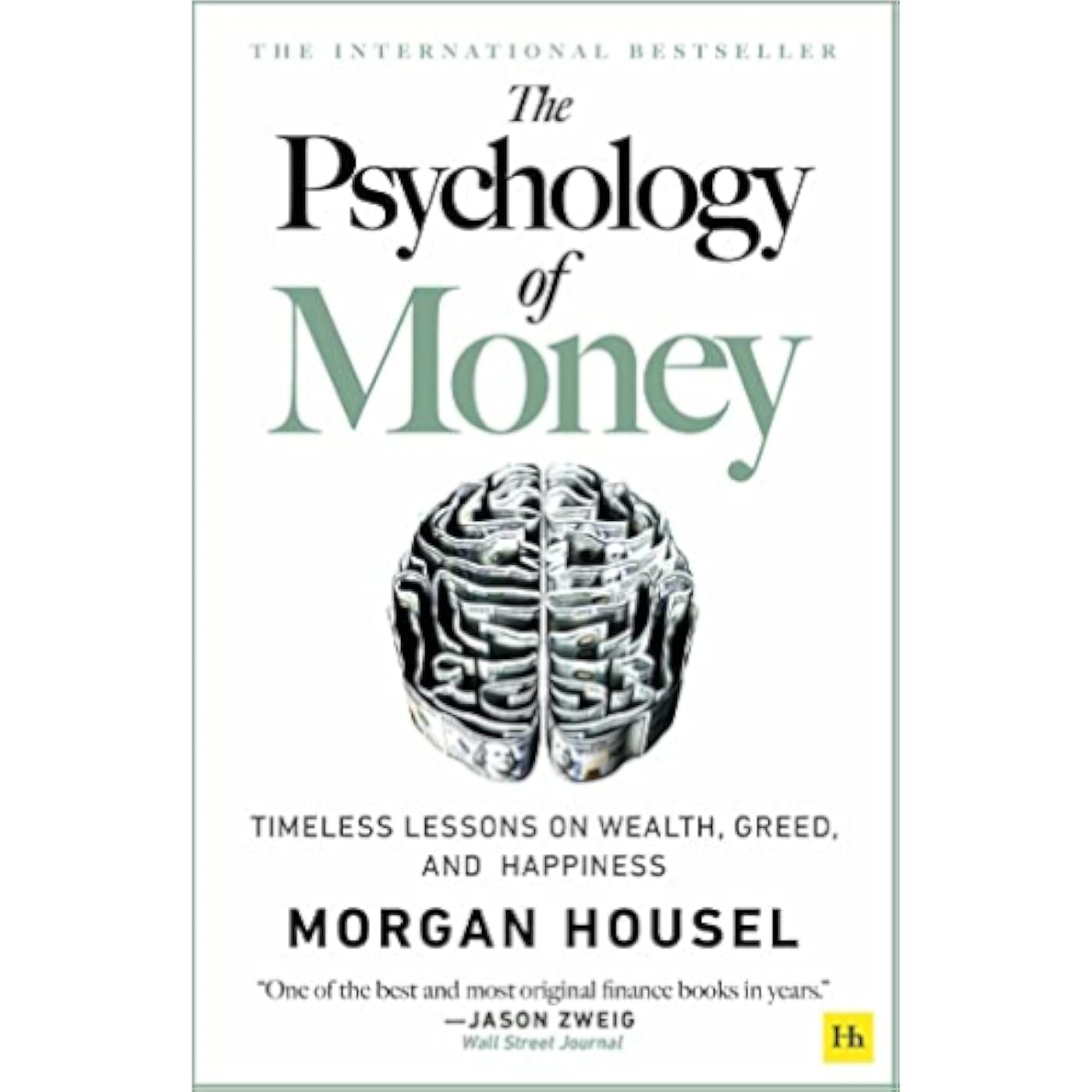

Publisher : Harriman House; Reprint edition (March 2, 2021)

Language : English

Hardcover : 256 pages

ISBN-10 : 0857199099

ISBN-13 : 96

Item Weight : 15.8 ounces

Dimensions : 5.5 x 1.2 x 8.5 inches

Best Sellers Rank: #1,844 in Books (See Top 100 in Books) #5 in Wealth Management (Books) #19 in Budgeting & Money Management (Books) #21 in Introduction to Investing

#5 in Wealth Management (Books):

#19 in Budgeting & Money Management (Books):

Frequently asked questions

To initiate a return, please visit our Returns Center.

View our full returns policy here.

- Klarna Financing

- Affirm Pay in 4

- Affirm Financing

- Afterpay Financing

- PayTomorrow Financing

- Financing through Apple Pay

Learn more about financing & leasing here.