Buy Now, Pay Later

- – 4-month term

- – No impact on credit

- – Instant approval decision

- – Secure and straightforward checkout

Ready to go? Add this product to your cart and select a plan during checkout.

Payment plans are offered through our trusted finance partners Klarna, Affirm, Afterpay, Apple Pay, and PayTomorrow. No-credit-needed leasing options through Acima may also be available at checkout.

Learn more about financing & leasing here.

Eligible for Return, Refund or Replacement within 30 days of receipt

To qualify for a full refund, items must be returned in their original, unused condition. If an item is returned in a used, damaged, or materially different state, you may be granted a partial refund.

To initiate a return, please visit our Returns Center.

View our full returns policy here.

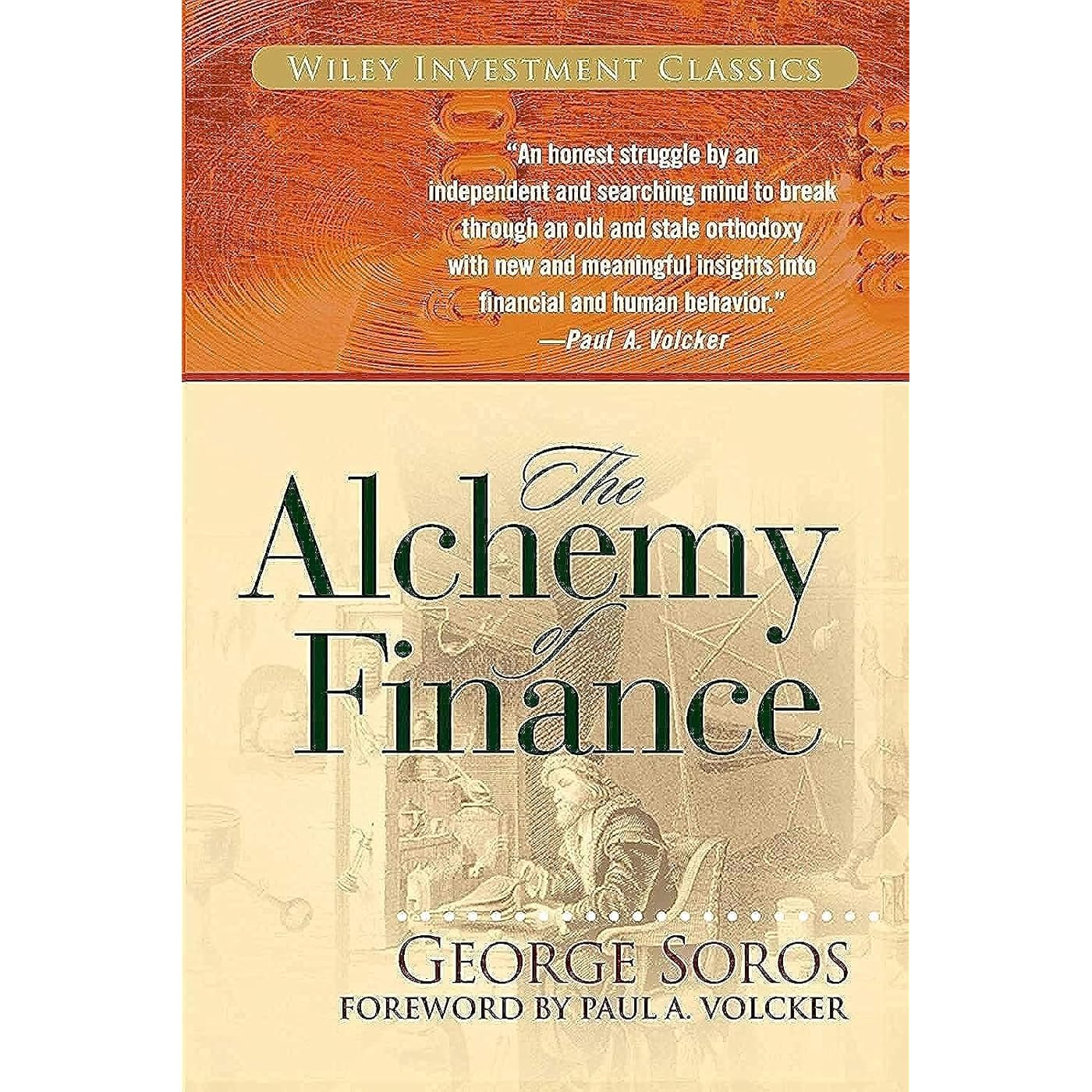

Description

New chapter by Soros on the secrets to his success along with a new Preface and Introduction.New Foreword by renowned economist Paul Volcker"An extraordinary . . . inside look into the decision-making process of the most successful money manager of our time. Fantastic." ―The Wall Street JournalGeorge Soros is unquestionably one of the most powerful and profitable investors in the world today. Dubbed by BusinessWeek as "the Man who Moves Markets," Soros made a fortune competing with the British pound and remains active today in the global financial community. Now, in this special edition of the classic investment book, The Alchemy of Finance, Soros presents a theoretical and practical account of current financial trends and a new paradigm by which to understand the financial market today. This edition's expanded and revised Introduction details Soros's innovative investment practices along with his views of the world and world order. He also describes a new paradigm for the "theory of reflexivity" which underlies his unique investment strategies. Filled with expert advice and valuable business lessons, The Alchemy of Finance reveals the timeless principles of an investing legend.This special edition will feature a new chapter by Soros on the secrets of his success and a new Foreword by the Honorable Paul Volcker, former Chairman of the Federal Reserve.George Soros (New York, NY) is President of Soros Fund Management and Chief Investment Advisor to Quantum Fund N.V., a $12 billion international investment fund. Besides his numerous ventures in finance, Soros is also extremely active in the worlds of education, culture, and economic aid and development through his Open Society Fund and the Soros Foundation. Read more

Publisher : Wiley (June 15, 2015)

Language : English

Paperback : 391 pages

ISBN-10 : 0471445495

ISBN-13 : 94

Item Weight : 2.31 pounds

Dimensions : 6.1 x 1.3 x 8.9 inches

Best Sellers Rank: #29,678 in Books (See Top 100 in Books) #19 in Investment Portfolio Management #59 in Accounting (Books) #65 in Stock Market Investing (Books)

#19 in Investment Portfolio Management:

#59 in Accounting (Books):

Frequently asked questions

To initiate a return, please visit our Returns Center.

View our full returns policy here.

- Klarna Financing

- Affirm Pay in 4

- Affirm Financing

- Afterpay Financing

- PayTomorrow Financing

- Financing through Apple Pay

Learn more about financing & leasing here.