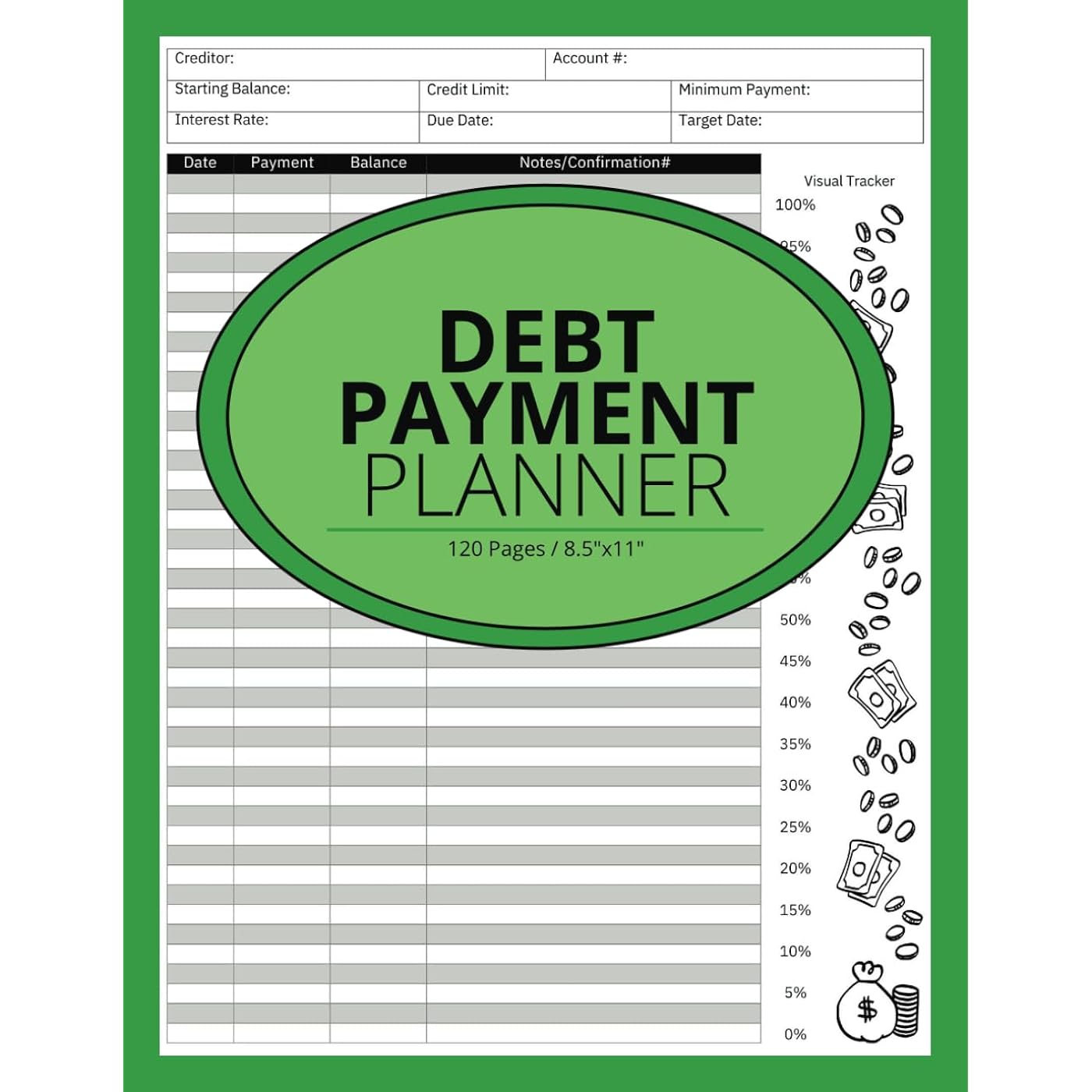

Debt Payment Planner: Utilizing Snowball and Avalanche Strategies for Effective Debt Elimination with a Visual Progress Tracker for Extra Motivation

Buy Now, Pay Later

- – 4-month term

- – No impact on credit

- – Instant approval decision

- – Secure and straightforward checkout

Ready to go? Add this product to your cart and select a plan during checkout.

Payment plans are offered through our trusted finance partners Klarna, Affirm, Afterpay, Apple Pay, and PayTomorrow. No-credit-needed leasing options through Acima may also be available at checkout.

Learn more about financing & leasing here.

Returnable until Jan 31, 2025

To qualify for a full refund, items must be returned in their original, unused condition. If an item is returned in a used, damaged, or materially different state, you may be granted a partial refund.

To initiate a return, please visit our Returns Center.

View our full returns policy here.

Recently Viewed

Description

Seize control of your financial future with our comprehensive Debt Payment Planner. Crafted to empower you in systematically eliminating debt, this planner seamlessly incorporates the potent snowball and avalanche debt payment strategies and a visual progress tracker to instill a sense of capability and motivation at every step.Key Features:Snowball and Avalanche Strategies: Learn and apply these proven methods to pay off your debts efficiently. Whether you prefer to tackle the smallest debts first or focus on those with the highest interest rates, this planner supports your chosen strategy.Initial Debt Overview Table: Catalog all your debts, including their balances, interest rates, and minimum payments. This feature provides a straightforward view of your financial situation, alleviating any sense of being overwhelmed.Individual Debt Pages: Transfer each debt to its dedicated page for detailed tracking. This feature allows you to break down your debt repayment into manageable steps and maintain focus on each debt.Visual Progress Tracker: Stay motivated by visually tracking your progress on each debt's page. As you make payments and reduce your balances, fill in the visual tracker to see your accomplishments at a glance.Encouragement and Guidance: The planner includes motivational tips and advice to help you stay motivated on your journey to debt-free.Why Choose This Planner?:Organized and Efficient: It helps you systematically organize your debt repayment strategy, ensuring that all your debts are tracked efficiently.Motivational: The visual progress tracker motivates you by providing a tangible representation of your progress.Customizable: Adapt the planner to fit your personal debt repayment preferences and strategies.Make the first step towards financial freedom today. With the Debt Payment Planner, watch your debt melt away, and your financial confidence soar. Read more

Publisher : Independently published (June 11, 2024)

Language : English

Paperback : 120 pages

Item Weight : 13.1 ounces

Dimensions : 8.5 x 0.28 x 11 inches

Best Sellers Rank: #139,528 in Books (See Top 100 in Books) #164 in Corporate Finance (Books) #512 in Budgeting & Money Management (Books) #1,407 in Education Workbooks (Books)

#164 in Corporate Finance (Books):

#512 in Budgeting & Money Management (Books):

#1,407 in Education Workbooks (Books):

Frequently asked questions

To initiate a return, please visit our Returns Center.

View our full returns policy here.

- Klarna Financing

- Affirm Pay in 4

- Affirm Financing

- Afterpay Financing

- PayTomorrow Financing

- Financing through Apple Pay

Learn more about financing & leasing here.

Top Amazon Reviews

![Hot Wheels '91 Mazda MX-5 Miata, Modern Classics 5/5 [Green]](https://m.media-amazon.com/images/I/81gHouVKbNL._AC_US500_.jpg)